Section 179 depreciation calculator

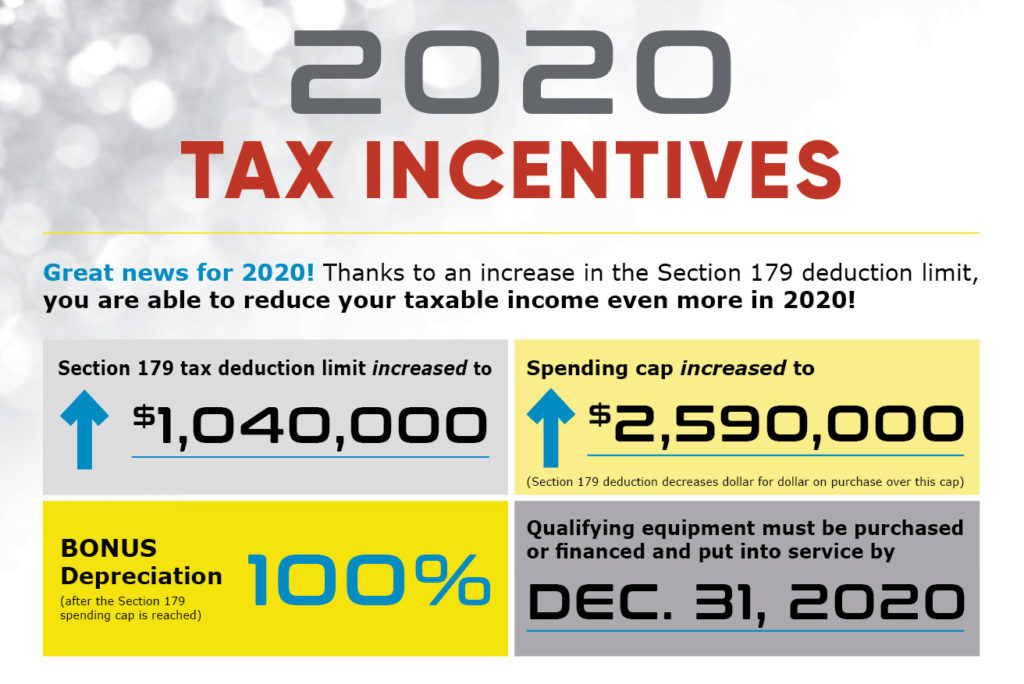

Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. This limit is reduced by the amount by which the cost of. 100 bonus depreciation for 2022 new and used equipment allowed.

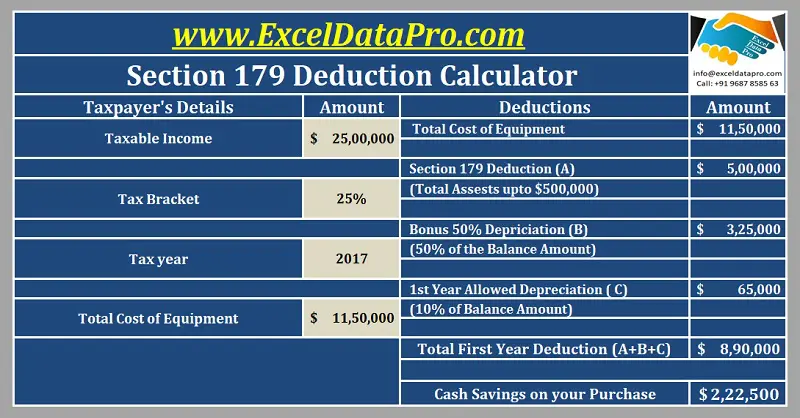

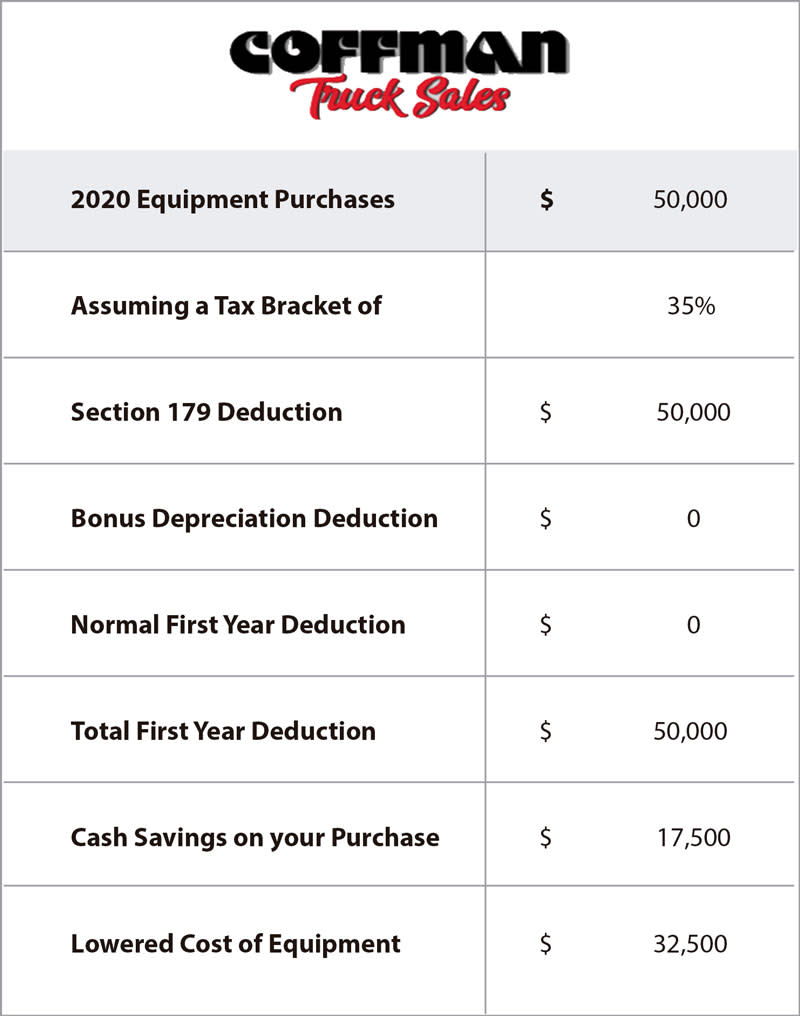

We Maximize Your Tax Deductions Credits To Ensure You Get Back Every Dollar You Deserve. Section 179 Tax Savings Calculator Put money back into your pocket The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying. Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year.

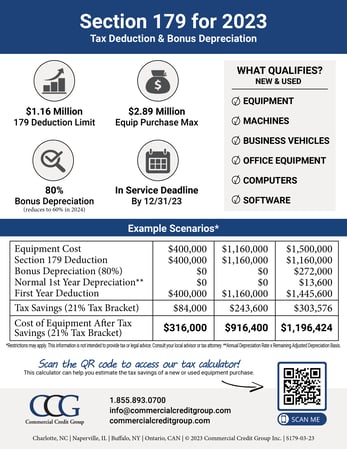

Contact a Section 179 Qualified Equipment Finance Lender to help you structure your equipment financing agreement to take full advantage of the benefits of Section 179. Section 179 deduction limit is now 1080000. The 2022 Section 179 deduction is 1080000 thats one million eighty thousand dollars.

Section 179 calculator for 2022 Enter an equipment cost. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Limits of Section 179.

Section 179 can save your business money because it allows you to take up to a 1080000. Section 179 Deduction Calculator Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. Section 179 deduction dollar limits.

The bonus depreciation calculator is proprietary software based on three primary components. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. 2022 Section 179 Deduction threshold for total amount of equipment.

But while Bonus Depreciation isnt technically part of Section 179 it can often be. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. For instance a widget-making machine is said to.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. A full 30k jump from last year.

Section 179 Calculator for 2022 Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. If the value of the equipment is less than 500000 then. For qualifying property you would still deduct just 1050000.

Make your pharmacy more productive profitable when you use this tax benefit with Parata. Prior Year Calculators Section 179 Tax Deduction Limits for year 2019. Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Bonus Deduction 50 of the Value left after deducting 500000. The Section 179 Deduction is now 1000000 for 2019.

This means your company can buy lease finance new or used. For passenger vehicles trucks and vans not meeting the guidelines below that are used more than 50 in a qualified business use the total deduction including both the Section 179. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2.

Section 179 Deduction Cost of Equipment up to 50000. This means businesses can deduct the full cost of. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

Use the Section 179 Deduction Calculator to help evaluate your potential tax savings. Thats where Bonus Depreciation comes in. Companies can deduct the full price of qualified equipment purchases up to.

Check for power outages near klamath falls or.

Macrs Depreciation Calculator With Formula Nerd Counter

Calculate Your Potential Section 179 Tax Deductions On New Equipment Bpi Color

Download Section 179 Deduction Calculator Excel Template Exceldatapro

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax

Section 179 Tax Deduction Home Facebook

Take Advantage Of The Section 179 Deduction Arcoa Group

Section 179 Calculator Ccg

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Deduction Hondru Ford Of Manheim

Calculate Your Potential Section 179 Tax Deductions On New Equipment Bpi Color

Section 179 Tax Deduction Groff Tractor Equipment

Tax Depreciation The Impact Of Depreciation On Taxes Agiled App

Section 179 Archives Stimulus Acts Section179 Org

Free Section 179 Deduction Calculator For Us Internal Revenue Code

Section 179 Tax Deduction Coffman Truck Sales

Depreciation Of Business Assets Definition Calculation How It Affects Your Taxes